KEY ANALYSIS POINTS

- Micromobility has recorded its largest expansion in these past two years. After the COVID-19 outbreak, users have prioritized commuting on bikes and electric scooters rather than cars and public transport.

- Micromobility’s growth is accompanied by an increase in the number of micromobility service providers. Many choose to focus on safety, to set themselves apart from the competition with insurance services that give their customers peace of mind.

- Both the creation of InsureTechs and the policies offered by micromobility providers are affecting an insurance sector that must adapt quickly to this ecosystem.

- The need for insurers to understand their customers better, as well as customers’ willingness to share personal data in exchange for personalized services, have popularized Usage Based Insurance (UBI).

- InsurTechs like Voom or Zego base their business models on UBI.

The COVID-19 pandemic has and will have effects and consequences for the mobility sector, and will continue to change how people commute in their daily lives. Lockdown and the widespread implementation of teleworking have resulted in a drop in road and public transportation, caused by confinement and uncertainty among the population, who were afraid of possible infection. According to data from the EFE news agency, the number of users of public transport in Spain fell by 46.7% in 2020, meaning there were 2.3 billion journeys less than in 2019 (1). Regarding private transport, data recorded by the Spanish Directorate General of Traffic (DGT) shows a 93.22% decrease in inter-urban light vehicle traffic, and city access fell by 89%, with an 86% traffic decrease inside cities.

This triggered a significant increase in the use of micromobility alternatives, like bikes and scooters, as a safe, quick and sustainable option for users. Data from a study by Moovit found that 31% of Spaniards used bikes or scooters in 2020, 7% more than in 2019.

Though it is true that, since the pandemic began, and during lockdown, the micromobility sector was also heavily affected by the suspension or reduction of services (Bird and Lime suspended operations in the USA, Canada and Europe, and Bird was forced to lay off 30% of its workforce), the sector’s recovery began with the gradual return of activity in 2020, and it has become apparent that users prefer to commute using more sustainable mobility options.

At present, micromobility has become one of the most popular ways to move around cities, mainly because of the reduced risk of COVID-19 infection when compared to public transport, but also thanks to the rise in sustainable mobility, a trend that has caught on in the last few years. According to data gathered by Lime in their latest study, 70% of users use less automobiles, taxis and carpools because of the many micromobility alternatives. Also, according to data compiled by McKinsey, by 2030 the micromobility market is expected to potentially move between 300 and 500 billion dollars globally.

Micromobility solutions help to tackle congestion on roads and in cities, significantly reducing carbon emissions and therefore presenting a very attractive solution for many users with environmental concerns. And not only for users; local government, too, is increasingly committed to the preservation of the environment, and this had led them to promote this type of mobility within cities.

THE IMPACT OF MICROMOBILITY ON THE INSURANCE SECTOR.

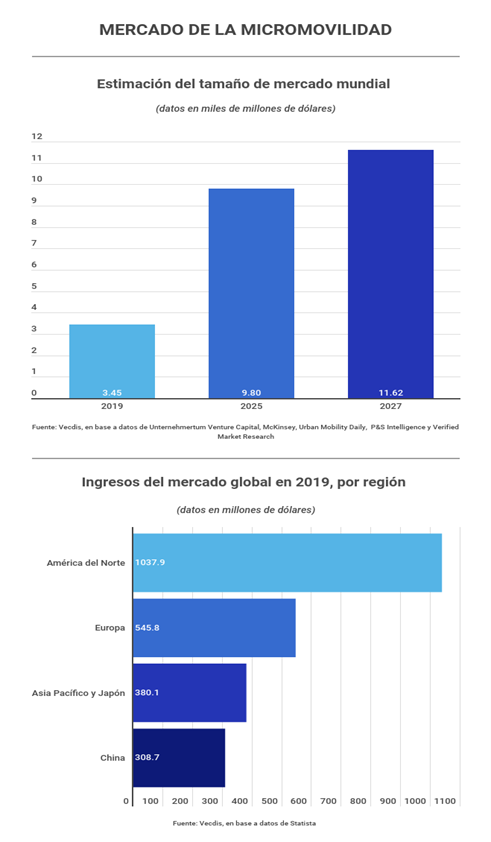

As the above graphic shows, micromobility will continue to grow exponentially until 2027. Drivers are beginning to leave behind the traditional vehicle ownership model and are now increasingly preferring to move around on bikes or scooters that also allow them to avoid congestion and save time when commuting. This has also weighed on the recovery of car sales: in January of this year, sales fell by 51% compared to the same month in 2020, and in February they fell again by 38.4%. Only 58,279 vehicles were sold in the last month. But the same cannot be said, for example, of scooters: according to data from internet portal idealo.es demand for this type of vehicle has increased in Spain by 142%.

Micromobility has become an indispensable part of the lives of its users in large cities. This growth has also brought about a considerable increase in the number of startups who provide micromobility services. Because of the proliferation of new competitors, players in this ecosystem are doing everything they can to set themselves apart from the competition, and to do so many are focusing on offering added value through safety.

This is where insurance becomes particularly important, as an insurance policy that protects users and third-party liability, while giving peace of mind during travel, can make the difference and give a competitive advantage. In addition, recent norms and regulations are a pre-requisite for providers who wish to obtain the necessary licenses.

This has motivated many micromobility providers to begin offering insurance integrated into their platforms, and this will represent a source of business for the insurance industry over the coming years. Users have already started to take out customized insurance directly with micromobility service providers.

InsureTechs have also made their appearance in the sector. In fact, a study by Everis in collaboration with NTT Data reveals that in 2019, most of the investment made by InsureTechs focused on cloud solutions, mobility and Artificial Intelligence, which gives an idea of the potential investors identify in the field.

Insurers cannot allow themselves to fall behind and are looking for a way into the ecosystem, offering customized and differential policies that cover the needs of new multimodal customers who toggle between various mobility options for short urban trips, such as shared bikes and scooters.

UBI POLICIES GAIN IMPORTANCE IN MICROMOBILITY

For insurers to continue to be relevant they must learn to better understand their customers, know their needs, preferences and behavior, to offer hyper-personalized products and services, while creating better experiences. This information is obtained thanks to customer data and analysis.

This data can be easily accessed and updated in real time in micromobility networks, thanks to GPS locators, mobile apps used by providers, and sensors installed on bikes and scooters, which help insurers get a better understanding of their customers’ driving habits.

The interest shown by insurers and InsureTechs, as well as by consumers, in sustainability and sharing personal data in exchange for a customized offer, has impacted on micromobility insurance, popularizing usage-based insurance for vehicles like bikes or scooters. Consumers demand a customized offer that is based mainly on how they use or drive the vehicle.

According to the report Insurtech Global Outlook by Everis and NTT Data, UBI policies, based on technologies like the IoT, Artificial Intelligence, or Cloud&Mobile Applications, gained importance compared to others, receiving 90% of investment.

CASE STUDIES

The following is an analysis with some recent success stories about InsurTechs who offer UBI policies for micromobility

VOOM

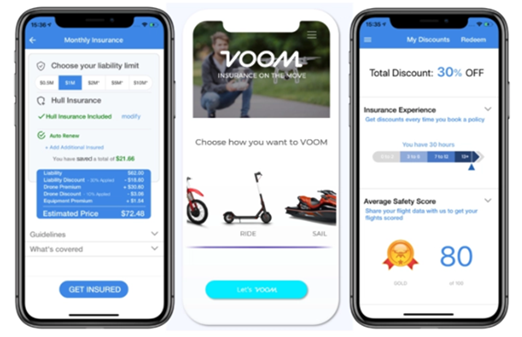

Founded in 2016 and launched officially in May 2019, Voom is a digital InsureTech that operates in the USA and creates innovative insurance products for today’s new mobility. It is designed for occasional users of on-demand mobility services, providing them with protection against accidents they may be involved in, or liability insurance for third parties or property.

The policies offered by Voom are provided by SkyWatch Insurance Services, Inc, an insurance agency with license to sell insurance products that cover property accidents, and who receive a fee from insurance companies for those sales.

Given that users make limited, occasional use of these services, rather than paying for full insurance, Voom offers a «pay-per-use» model for each trip, designed specifically for micromobility services like electric bikes or e-scooters.

Source: Venture Beat

Main features:

- 100% digital insurance.

- «Pay-per-use» model.

- Coverage against accidents that affect users.

- Coverage for third parties involved in accidents.

ZEGO

Based in the United Kingdom and founded in 2016, Zego is an InsureTech that offers insurance for today’s new forms of mobility. They provide special policies for drivers of vehicles for hire, delivery riders on motorbikes, and users of e-bike and e-scooter rental services.

Some of their main partners are Deliveroo, OLA, Uber, Uber Eats, Bolt or FreeNow. Their insurance coverage is provided by Wakam, who create customized insurance for their partners.

Their «pay-per-use» model means that customers can adjust the cost of insurance to their needs, depending on how long they will use the vehicle, or the distance traveled, and can choose whether they want to cover damages to third parties, to themselves, or both.

They have recently partnered with Brite, a mobility provider in Ireland that offers vehicles for gig workers.

Main features:

- Digital insurance.

- «Pay-per-use» model. Flexible policies available by distance or time.

- Coverage against vehicle loss or damage.

- Damage to third-party property.

- Limited coverage against user and third-party bodily injury.